Us Bank Mobile Deposit

- In its 2021 Mobile Deposit Benchmark report, the firm wrote, “It’s clear that U.S. Bank has taken the importance of mobile banking very seriously and truly demonstrates what a powerful tool mobile deposit can be for customers. Effortless to use and confidently designed, the bank’s consistent improvements have brought it to the top.”.

- Digital storage offers the perfect blend of online convenience and safe deposit box security. Click on the My Membership tab for access to the Virtual StrongBox feature. Popmoney® is a personal payment service that allows you to send money electronically. All you need is the recipient's name and email address or mobile telephone number.

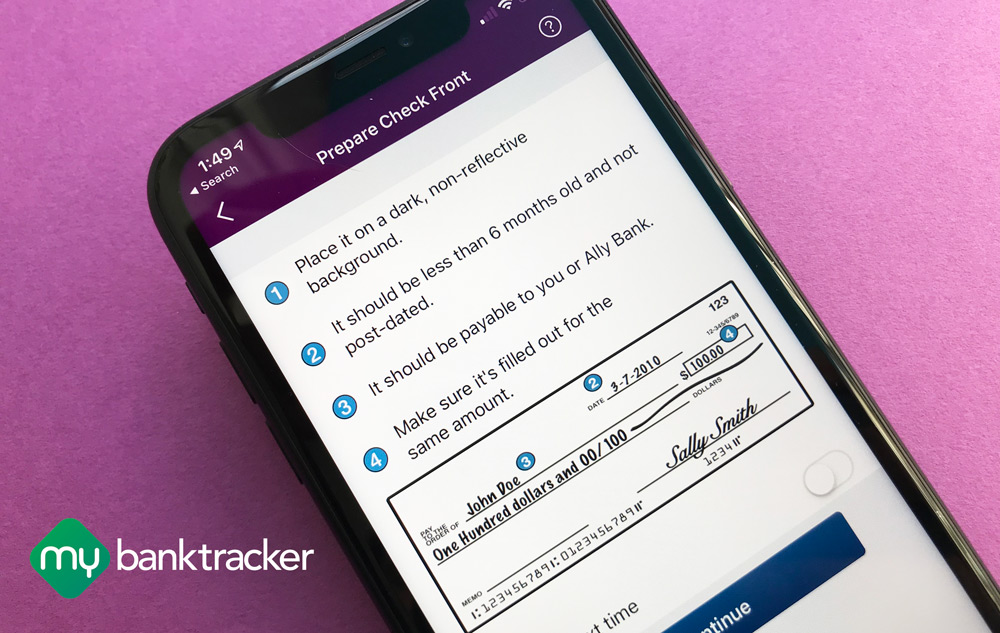

- Download the U.S. Bank Mobile app and from the account dashboard choose Deposit at the bottom left of your screen to get started. Note: Mobile Check Deposit is only available on the mobile app. Check deposit is not available on online banking. Safe debit accounts are ineligible for 30 days after opening for new customers.

US bank and credit union customers didn’t seem to miss visits and lineups at their favorite financial institution during the past year. In fact, in the space of 10 months during the pandemic, 42% of customers used mobile deposits for the first time.

Banks and credit unions haven’t been quick to eliminate branches with services deemed essential during the pandemic, but many temporarily reduced in-branch services dramatically to protect customers and staff. Instead, new online and mobile banking features and drive-through banking have grown popular quickly.

Up to $225 in cumulative daily deposits are generally available immediately – and when you make a deposit by 9 p.m. CT, the balance is typically posted to your account the following business day. More about mobile check deposit Send money to almost anyone with a bank account in the U.S. For the best mobile banking experience, we recommend downloading and using our iPhone or Android mobile app. Click here to download the app. IPhone/Android Mobile App steps: From the account dashboard, select Deposit a check on the bottom menu, then select View mobile deposits. Use the tabs to view Past or Pending deposit history.

Mobile banking is another indicator of how fast financial services preferences and banking habits have shifted due to the coronavirus impact, according to the fifth annual Mobile Deposit Benchmark Report by Cornerstone Advisors and Mitek.

Mobile banking and many won’t change their new habit

Us Bank Mobile Deposit Faq

According to the report, customers have embraced mobile banking, and many will no longer do most of their banking in-branch even after a return to “normal.”

“We are seeing the sort of increases in consumer use of mobile deposit that would have taken 10 years in normal times, but in pandemic times only took 10 months to achieve. And a huge percentage of these new users will not return to the old ways of depositing their checks even once the pandemic has passed. Higher percentages of customers using mobile deposit is the new normal,” said Mike Diamond, Mitek SVP and General Manager of Digital Banking.

With the safety and convenience of mobile check deposits, why would you get in the car for a trip to your nearby bank or credit union when you could deposit it at home? While we’re at it, who needs cash anyhow?

Five trends to watch in 2021

The report shows just how strong these new consumer banking preferences are:

- 85% of consumers using mobile deposit plan to continue doing this in 2021, with 8% not sure, and 6% not planning to continue

- 70% of consumers prioritize mobile deposit in the list of banking capabilities they look for

- Policy decisions, including check hold times and deposit limits, continue to constrain use

- Technology quality is the #2 issue for consumers, after policy decisions

- Design and user experience continue to dictate consumer satisfaction with mobile deposit and FIs.

Us Bank Mobile Deposit Error

There’s some clear insight for financial institutions as they seek ways to compete with new digital bank startups and competitors with features-heavy product and service offers.

What features do bank customers want?

Last year, 52% of respondents ranked mobile check deposit as one of their most important mobile banking features. In 2020, 70% said it’s an important or critical feature of their bank.I

The most “critical/important” features bank and credit union consumers want from their mobile banking app include managing balance or fraud alerts (77%); turning cards on/off and lost current reporting (77%); mobile check deposits (70%); credit report info (54%); person-to-person (P2P) payments (53%); tap-to-call customer service (48%); picture bill pay (43%); budgeting tools (40%); cardless ATMs (39%); scheduling branch appointments (39%); travel notifications (36%); and, surprisingly, Apple watch integration (31%).

Among the features not understood were Apple watch integration (22%), cardless ATMs (11%), picture bill pay (10%), and budgeting tools (7%).

The key mobile banking features used most by consumers in the past 12 months on their smartphone or tablet were checking balances (91%), bill payment (62%), money transfers between accounts (61%), mobile check deposits (40%), P2P money transfers (39%), viewing statements (34%), payments with Apple Pay or Google Pay (24%), and accessing coupons ordeals for discounts (14%).

At least half (52%) of customers had at least one problem with a mobile deposit in the past 12 months. Other problems included not getting funds fast enough (21%), difficulty getting a clear picture of the check for deposit (21%), unsure if deposit was successful (14%), low dollar limit prevented deposit (13%), inability to deposit many checks at once (11%), and confusion about how to use features (4%).

When it comes to the reasons for not using mobile deposits, banks should note 23% wanted faster access to their funds, 19% said their check deposit limit was too low, 17% said they had technical difficulties, 16% said they had exceeded their monthly deposit limit, 15% had security concerns about their deposit. Interestingly, 3% did not want their spouse/SO to see their check deposit.

Banks and credit unions, are you listening?

Best-rated mobile banking services

Cornerstone ranked the financial institutions’ mobile banking services, identifying several key insights about important policies such as low deposit limits and lengthy check holding time, both important features for consumers.

The top five financial institutions with the best overall mobile check deposit customer experience included US Bank, Chase, Fifth Third, SunTrust, and Capital One.

“Policy decisions played a big role in the 2021 rankings, as well. Fifth Third, which cracked the top three for the first time, made large strides in policy and risk management, cutting check hold time to five days, down from 14 in previous years. Chase, ranked number one in 2020, was knocked down a notch in 2021 and might have held the top spot with larger deposit limits,” the report said.

Fifth Third offered the highest personal deposit limit at $50,000, while Capital One had the best-recommended paper check retention at just one day. All 20 financial institutions surveyed offered auto-capture for the first time.

When you get right down to it, given the pandemic, mobile bank deposits were simply the right feature at the right time. The jump in adoption that happened in the past 10 months might normally have taken 10 years to rollout.

US bank and credit union customers seem increasingly open to other digital banking features on the horizon. More than anything that may dictate how many branches financial institutions need to retain in the future.

Cornerstone Advisors surveyed 1,968 US consumers in Q4 2020, and you can view additional 2021Mobile Deposit Benchmark Report highlights or download the full 43-page report for free here.

Remote deposit is the ability of a bank customer in the United States and Canada to deposit a cheque into a bank account from a remote location, such as an office or home, without having to physically deliver the cheque to the bank. This is typically accomplished by scanning a digital image of a cheque into a computer, then transmitting that image to the bank. The practice became legal in the United States in 2004 when the Check Clearing for the 21st Century Act (or Check 21 Act) took effect, though not all banks have implemented the system.

This service is typically used by businesses, though a remote deposit application for consumers has been developed and has begun to be implemented by a handful of banks.

Remote deposit should not be confused with:

- Direct deposit, which refers to the practice of posting amounts, such as employees’ weekly earnings, directly to their bank accounts.

- Online deposit, which refers to a retail banking service allowing an authorized customer to record a check via a web application and have it posted, then mail in the physical check, giving the customer access to the funds before the check clears in the usual way. While this type of service does not involve a scanner nor take advantage of the Check 21 Act, it is also sometimes called remote deposit.[citation needed]

History[edit]

Remote deposits became legal in the United States in 2004 when the Check Clearing for the 21st Century Act (or Check 21 Act) went into effect. The Act is intended in part to keep the country's financial services operational in the event of a catastrophe that could make rapid long-distance transportation impossible, like the September 11, 2001, attacks. The Check 21 Act makes the digital image of a check legally acceptable for payment purposes, just like a traditional paper check.

Before 2004, if someone deposited a check in an account with one bank, the banks would have to physically exchange the paper check to the bank on which the check is drawn before the money would be credited to the account in the deposit bank. Under Check 21, the deposit bank can simply send an image of the check to the drawing bank. This reduction of the transportation time from total processing life cycle of a check provides a longer time for the corporation to process the checks. Often, this additional processing time allows the corporation to deposit more items at an earlier cutoff time than they otherwise would. In addition, most banks offering Remote Deposit Capture have extended the cutoff times for deposit-8:00 pm, while the deadline for regular paper deposits is 4:00 pm. The practical effect of the law is that checks can still be deposited and cleared, even if a disaster makes it impossible for banks to exchange the physical paper checks with each other.

Mobile deposit[edit]

On July 4, 2009, Element Federal Credit Union (formerly WV United FCU[1]) became the first financial institution to deploy a smartphone app for its members. Members were already able to submit checks for deposit by using a scanner and secure web portal. USAA in 2009 became the first bank to enable customers to deposit checks with a smartphone. Mobile Deposit allows smart phone users to snap a picture of the check with the phone's camera. The application automatically processes the picture and sends it to the bank for deposit. The customer does not mail in the original check, instead voiding or discarding it.[2]

According to an industry study conducted in late 2013, only 10% of U.S. banks and credit unions offered mobile deposit, though many more planned to do so.[3] Some of the largest U.S. banks offer mobile deposit, including Bank of America, Chase, Citibank and Wells Fargo[4][5][6][7] and some in Canada, RBC,[8]TD,[9]CIBC,[10]Tangerine[11] offer mobile deposit to retail banking customers.

Implications for businesses and consumers[edit]

A side effect of the Check 21 Act is that, because the digital image of a check is now considered a legal document, bank customers who get paid with a check can scan an image of the check and deposit it into their account from their home or office if their bank supports doing so.

Advocates of Check 21 claim that remote deposit saves time and money because businesses who use it no longer have to send an employee or a courier to take their checks to the bank. Another potential benefit is that it cuts down on paperwork, and therefore reduces the chances of making mistakes or losing checks in the process of depositing them. Bounced checks also show up faster when processed through remote deposit.

Critics, and some advocates, contend that remote deposit — and by extension, the entire Check 21 Act — is an attempt by the banking industry to eliminate 'float,' the standard one- or two-day waiting period between the time someone writes a check and the time the money is actually taken out of their account. Now that checks can be cashed and cleared electronically, it is theoretically possible for a bank to take the money out of a checking account on the same day a check is used in payment. This would make checks behave much like debit cards, making it impossible, for example, to write a check to pay a bill at the grocery store, then rush to the bank to make a deposit so the check doesn't bounce. So far, all banks in the United States still operate with at least a one-day float period.[citation needed]

Use[edit]

Remote deposit use has grown. A June 2009 survey by group Independent Community Bankers of America found that 62% of banks in the United States offered merchant remote deposit, and 78% had plans to adopt the technology by 2011.

Client adoption of remote deposit capture was projected to reach 1 million by 2010, and over 5 million by 2012.[12]

The banking industry does not keep an official tally of how many businesses use remote deposit nationwide, but, the number is estimated to be in the tens of thousands. Several independent companies such as ProfitStars,[13]BankServ, Diebold, RDM Corporation and NetDeposit claim to have signed up a few thousand customers, although several major banks have also developed their own systems and may eventually end up handling most remote deposit traffic.[citation needed]

See also[edit]

References[edit]

- ^WV United Federal Credit Union is First with iPhone-based Remote Check Scan & Deposit Finovate Blog, Jim Bruene Posted on July 12, 2009

- ^Stellin, Susan (2009-08-10). 'Bank Will Allow Customers to Deposit Checks by iPhone'. The New York Times. pp. B4. Retrieved 14 December 2013.

- ^Camhi, Jonathan (2014-01-06). 'Celent: Banks Looking to Replace RDC Solutions'. Bank Systems & Technology. Retrieved 8 January 2014.

- ^'Mobile Check Deposit from Bank of America'. Bank of America. Retrieved 1 February 2014.

- ^'Chase QuickDeposit'. Chase. Retrieved 1 February 2014.

- ^'Mobile Check Deposit'. Citibank. Retrieved 1 February 2014.

- ^'Mobile Check Deposit'. Wells Fargo. Retrieved 1 February 2014.

- ^'Mobile Cheque Deposit – RBC Royal Bank'. www.rbcroyalbank.com. Retrieved 2015-12-02.

- ^'TD Mobile Deposit - Electronic Banking TD Canada Trust'. www.tdcanadatrust.com. Retrieved 2015-12-02.

- ^'CIBC eDeposit – Deposit cheques with your mobile device'. www.cibc.com. Retrieved 2015-12-02.

- ^'What is Cheque-In™'. Mobile Tangerine.

- ^Celent's estimates were published on 4 June 2007.

- ^ProfitStars

- Remote Deposit Capture Comes with Some Risks - A Short Description of Remote Deposit Capture

- RDC Overview Overview of Remote Deposit Capture