Uob Cheque Deposit

- You can check the balance of your savings accounts, current accounts, fixed accounts, and credit/debit/CashPlus card accounts in real-time or specific date range, dating back up to 90 days, 24 hours via your mobile phone.

- Pay bills and services via UOB Mobile immediately or set future date payment or recurring payment of up to 12 months consecutively by yourself everyday, 24 hours.

- Quick Pay

Quick Pay will immediately perform payment without having to add payee. Suitable for one-time payment or payment that is not regular. - Pay Bill

Pay Bill, you will have to add payee before performing payment. Suitable for regular payments. The system will memorise the payee details for the next time. - Pay your UOB credit card

can be paid immediately. Just choose a credit card payment. The amount will be credited to your account immediately after a successful payment.

Remark : You can add up to 30 Billing Organisations and pay bill by yourself, 24 hours.

For Privilege Banking customer, the maximum of 100,000 THB/day. You can also increase the payment limit up to 1,000,000 THB/day.

For general customer, the maximum of 100,000 THB/day. You can also increase the payment limit up to 500,000 THB/day. - Quick Pay

- If you currently have UOB account and would like to do a fund transfer between your own accounts or to third party accounts within UOB.

- Funds Transfer between your Own Accounts without a transfer limit per day.

- Funds Transfer to UOB Third Party Accounts maximum limit of 300,000 THB per day.

- Funds Transfer to other Bank Accounts maximum limit of 300,000 THB per day.

Funds Transfer Type

- Immediate Transfer

You will have to add payee before performing funds transfer. The system will memorise the payee detail for the next time. - Future Dated Transfer

can be set up in advance up to 12 months by specifying the transfer date. - Recurring Transfer

can be set up as daily, weekly, monthly, and quarterly and can be set up in advance up to 12 months.

- In Inbox, you will receive special exclusive promotions from UOB that are relevant to you.

- Manage Account Summary View

Manage your Account Summary View page and Homepage to facilitate your activities via UOB Mobile. Simply click the account numbers you wish to be displayed on the Account Summary View page and homepage to manage those pages by yourself. - Link Accounts

“Link Accounts” allow you to link your personal UOB accounts to UOB Mobile and UOB Personal Internet Banking for viewing or to perform online transactions. If you intend to access your bank account via UOB Mobile, you will need to ensure that the account is linked. - De-link Accounts

“Delink Accounts” allow you to delink your accounts from UOB Mobile and UOB Personal Internet Banking whenever you don’t intend to access your accounts online. - Edit Personal Particulars

Update your personal information via UOB Mobile by yourself, for example, education, marital status, occupation, mobile phone number, and email.

- Remark :

- UOB will use your specified mobile phone number for reference only. If you wish to change the mobile phone number registered for SMS-OTP and/or UniAlerts, please contact any UOB branch at your convenience.

- UOB will use your specified email for reference only. Your email registered for UOB newsletters and/or UniAlerts will not be changed.

- Manage Account Summary View

- You can request for a credit card temporary limit increase easily via UOB Mobile and find out instantly if it is approved.

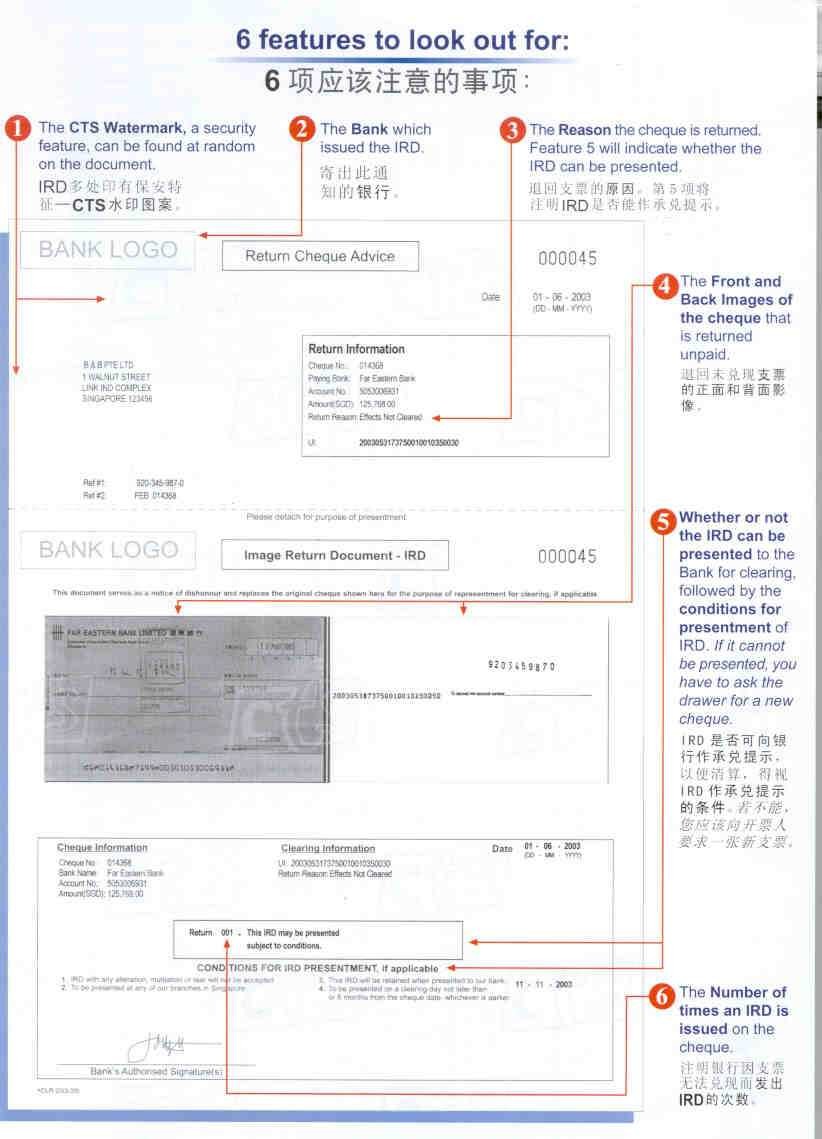

Remark : Credit Card Temporary Limit increase is applicable for primary cards only. The supplementary card cannot perform this service. - Cheque Status Enquiry

You can enquire up to a maximum of 5 cheques status by yourself. - Stop Cheque Payment

Customers who have current accounts with UOB are able to stop cheque payment easily via UOB Mobile by yourself. Remark : You can stop cheque payment up to 5 cheques/transaction by filling in the first and last cheque numbers. However, the cheques numbers must be in consecutive order. - Request Cheque Book

Customers who have current accounts with UOB can request for cheque books easily via UOB Mobile.

Remark : You are able to request cheque book up to 2 cheque books/transaction. The request transactions per day is unlimited.

- Cheque Status Enquiry

- Personalise Menu

You can customise your Homepage after you login to UOB Mobile. This feature allows you to sort the new menu and/or hide the menu if desired. - Change Password

For security purposes of performing transactions via UOB Mobile, please change your password regularly.

Remark : Your new password must consist of numbers and letters or pure numbers at 8 - 24 characters. Do not type in space and please beware of case sensitive.

- SecurePlus Token Activation

You will need to activate your SecurePlus token before using it.

Remark : Please note that you will automatically be logged out from UOB Mobile. Please log in again to initiate the service.

- Personalise Menu

Uob Cheque Deposit To Posb Bank

Uob Cheque Deposit Cut-off Times

Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. Locate a Quick Cheque Deposit Box near you or visit our 24/7 Self-Service branches! Select cheque currency. Singapore Dollars US Dollars (issued by local banks) Other Currencies (incl. USD cheques issued by foreign banks). How To Deposit Cheque. After you have checked the cheque details and filled in your own bank details, You can: Drop cheque at the Quick Cheque Deposit Box (QCD). These collection boxes are available at the banks’ branches in Singapore. POSB/DBS also have Quick Cheque Deposit Machine (QCM) for their customers; Also read: How long for bank. Cheques are valid for 6 months from date of issuance, unless otherwise stated on cheque. Locate a Quick Cheque Deposit Box near you or visit our 24/7 Self-Service branches! Enquire your cheque status that you have issued or deposited in the past 6 months. To ensure that funds are made available in time, please refer to Cheque Clearing. Minimum account opening must be at least USD 500.00 or equivalent, except for companies registered in Thailand; If savings account is a non-active account over 1 year, the Bank will debit maintenance fee as specified in each currency.